The rapid development of financial technology (Fintech) has redrawn the landscape of bill payments, making them more efficient, secure, and accessible. Traditional methods, once the backbone of financial transactions, are being challenged by the swift and user-centric services offered by Fintech. The need for speed, convenience, and transparency in financial operations drives this shift. As the digital age progresses, the integration of these technologies into everyday financial practices not only enhances user experience but also pushes traditional institutions to adapt or innovate. In the following sections, doxo delves into various aspects of this financial revolution, highlighting the benefits and challenges it presents, as well as its real-world applications and future trends.

Traditional Bill Payments and Fintech Overview

Traditional payment methods have primarily relied on manual processes involving cash, checks, or direct bank transfers. These methods, rooted in long-established banking procedures, often require physical interactions or postal services, leading to longer processing times and increased potential for human error. Over time, these systems have seen some digital integration, yet many core elements remain unchanged.

As technology has advanced, Fintech companies have emerged to disrupt the financial services sector. Fintech combines innovative technologies and modern financial practices to enhance the efficiency and accessibility of financial services. This includes the development of digital-only banks, payment platforms that allow instant transactions, and financial management apps that cater to a mobile-savvy consumer base. The rise of Fintech represents a shift towards more agile, user-focused financial systems that contrast sharply with traditional banking frameworks.

The intersection of traditional bill systems and Fintech solutions highlights a growing trend toward digitization and automation in financial transactions. As traditional methods merge with modern technological innovations, users are witnessing a significant change in how financial transactions, including bill payments, are conducted, setting a new benchmark for convenience and efficiency in financial services.

Fintech Innovations in Bill Payments

Paying bills has been significantly reshaped by innovations in Fintech, introducing tools like digital wallets and mobile payment systems. These platforms facilitate transactions that are not only quicker but also more secure. The integration of automated payment solutions allows for real-time processing that can bypass the delays typically associated with traditional banking procedures.

Security measures within these systems have also seen revolutionary enhancements. Biometric verifications, utilizing fingerprints or facial recognition, ensure that transactions are not only faster but also safer. This layer of security is crucial in building user trust and encouraging the adoption of new payment technologies.

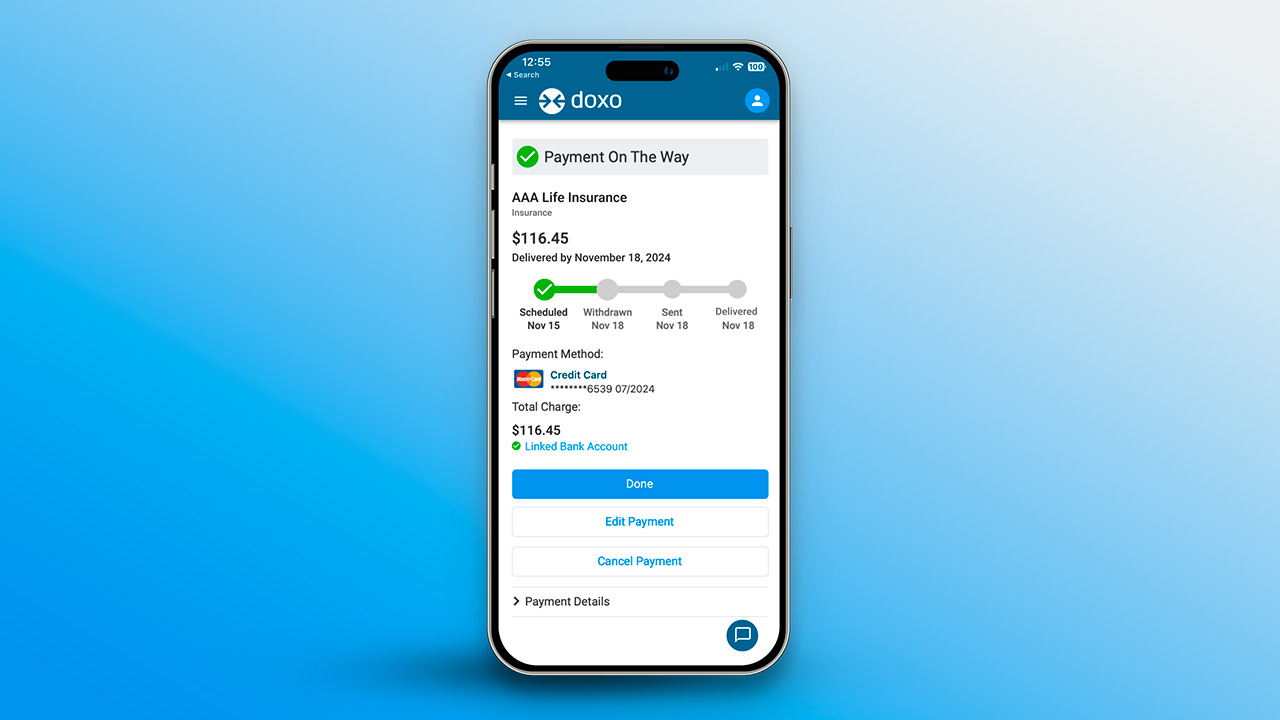

Amid these advancements, the user experience has become more seamless and user-friendly. The convenience of managing payments from a smartphone has empowered consumers, offering them control over their financial transactions with unprecedented precision and simplicity.

Advantages of Using Fintech for Bill Payments

The adoption of Fintech in bill payments brings numerous benefits, primarily centered around convenience and efficiency. Users can conduct payments from anywhere, at any time, a significant leap from the rigid timings of traditional banking hours. This flexibility is a major boon for consumers who juggle busy schedules.

Moreover, processing times and associated costs are reduced, another critical advantage. Fintech solutions often bypass many of the manual steps involved with traditional systems, resulting in lower fees and faster transactions. This cost-effectiveness, paired with enhanced speed, appeals to both individual consumers and businesses alike.

The improvements in transparency and tracking are equally significant. Modern Fintech applications provide users with detailed transaction history and real-time updates. This level of insight into financial activities was more challenging to achieve with older systems, where records were not as easily accessible or transparent.

Challenges in Integrating Fintech with Traditional Systems

Integrating Fintech solutions with traditional banking systems presents a set of unique challenges, particularly with privacy and data security. As financial transactions become increasingly digital, the volume of sensitive data being transferred escalates, necessitating advanced protective measures. The complexity of aligning new technologies with outdated infrastructures can also pose significant hurdles, often requiring extensive updates or complete system overhauls. Luckily, modern advances in security measures have also seen revolutionary enhancements, making transactions safer and more secure than they have ever been.

Real-World Applications and Impact

The impact of Fintech on traditional bill payment methods can be seen across various sectors. In retail banking, for example, the introduction of instant payment services has dramatically changed consumer expectations. Customers now anticipate immediate processing, a stark contrast to the days of waiting for checks to clear.

Similarly, small businesses have benefited from Fintech solutions that offer streamlined invoicing and efficient, low-cost transaction methods. These tools not only simplify financial management but also enhance cash flow, a critical element for the survival and growth of small firms.

Looking Ahead: Future Trends in Bill Payment Technology

Emerging technologies continue to shape the future of bill payment systems. The potential introduction of AI-driven predictive analytics promises to offer even more personalized financial services. For example, by analyzing spending patterns, these systems could automatically manage recurring payments, ensuring funds are always allocated efficiently.

As consumer expectations change, the pressure on financial institutions to keep pace intensifies. The future of bill payment technology is likely to be characterized by a blend of innovation, efficiency, and personalized financial solutions, marking a significant shift from traditional transaction methods to a more integrated financial framework.

No hay comentarios:

Publicar un comentario